-

Posts

1,085 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Store

Gallery

Community Map

Everything posted by Arwen

-

A question about your trousers

Arwen replied to narp's topic in Clothing, Luggage, Accessories and Security

High trousers = no builders cleavage. -

Lol whoops! Will delivery on a dark and stormy night cover the damage?

-

Lol I'm not sure I really want to do this. Percentage wise mine is rediculious! Msx - bought new for £2500 Bought over the past 4 years: Seat =£70 Indicator drl mod =£35 Gear shifter mod =£12 SS braided lines =£85 Akrapovic end can (and titanium header pipe) =£360 (+£240) Total farkles = £802 (or 32% of initial purchase price ) And if you want to count them Rack and top box I got free due to delays with delivery =£150 New tyres, chain and sprockets cause stock are crap = £110

-

They didn't charge me to move home tbf. As of yesterday I'm now with admiral though as they were cheaper. Lucky! Charged us £40 for the pleasure of updating our details, and another £70 for making the bike more secure (by being in a garage...)

-

I'd never insure with MCE. Rip of merchant charge you £40 for absolutely everything!

-

I paid £500 deposit for my F700, only because it allowed me then to get a deposit contribution of £1500 plus a lower interest rate. My GFV is around the £3k mark if I remember correctly. This is on a 4 year deal. So currently an average 4 year old F700gs from a main dealer is around £4500-£5000. Trade in I would say would be around £3500-£4500. I treat pcp as long term renting, and if I like it I can buy it at the end. I'm not a fan of changing bikes often so long term PCP suits me. Ideally I would not have put £500 deposit down, but this would have meant I would have been some £2k out of pocket due to deposit contribution and better finance rate. It's all about the maths!

-

I don't think it makes a difference does it? And the downside is that if you wish to sell early you'll be in negative equity. That's where I am now You lose even more if you swapped while in negative equity if you put down a large deposit (deposit + neg equity). I suppose you would get out of neg equity quicker, but if you like to change bikes often then you should go for short PCP deals. The GFV technically shouldn't change much depending on the deposit you put down. Your monthly payments will change, but over the life time of the policy it normally works out better to put down less deposit. The GFV is generally mid range for predicted trade in value. So say your GFV is £4500, but when it comes to trading in, the bike is valued at £5500. If you put down a deposit of £500, then £500 is "profit". If you put down £2000 deposit then you don't see the "profit" at all. This assumptions are of course interest free. Do the maths with the different interest rates to work it out.

-

Lots of deals to be had. If you are going the PCP route, best to put down as little deposit as possible. Then any additional worth on the GFV amount is "profit" to you.

-

Fantasy land! Get a husky 401 vitpelin or svartpilen .awesome looking bikes, I would have one in a heart beat if I could reach the floor when on them

-

And I thought Germans like efficiency

-

Oh these bikes can be the most stupidly named bikes on the planet I reckon... Echo all of what [mention]Gerontious[/mention] has said, with the addition of some F650gs's are 800cc engines. Also, the f700gs is the same, slightly differently tuned engine... It's replaced the f650gs, and has now been replaced by the f750, which is also a 800cc engine

-

That does seem like a short interval to be honest. My Honda 125 the book says every 7500 miles to clean it. Apparently on the newest ones it is now every 10k. An oil change every 2500 miles though.

-

Have you cleaned out the switch gear yet? The stiff, spongy feeling would be to do with the switch gear. The delay could be the relay, or the switch gear. Once the indicators are on are the flashes consistent? I bought my relay from ebay with no problem. If you are just looking for a direct replacement then search for the part number or the specifications that are normally written on the side of the relay. You could always go to your local dealer too. or WeMoto

-

Low emission zone frame log number change? Help.

Arwen replied to Tw125's topic in London & South East Rideouts and Meets

No insurance becuase your insurance is only valid for your current vin and registration combo. Vin number is the frame number. If anything changes with the frame (such as a frame swap) the DVLA must be notified - https://www.gov.uk/vehicle-registration/vehicle-identification-number No MOT as this is on the registration and vin number combo at the time of testing. If there is a discrepancy in the vin reg combo at testing, dvla and/or police are notified. -

If you like the mutts then the style you are looking for is "retro" bikes. Triumph bonneville, Harley Street Rod, Honda CB-series , Yamaha SCR for example.

-

Gloves and grips combo

Arwen replied to RAYK47's topic in Clothing, Luggage, Accessories and Security

I love Halverssons gear. I also have their gloves as they are one of the few brands that fit me well. I'd definitely recommend any of their kit to anyone. Outlast liners are magic As for glove and grip combos. If you have heated grips you want a non heavily padded palm on your glove, otherwise you don't feel the heat from the grips as good. -

I'll echo what the rest have said. Don't skimp on tyres. What sizes do you need ?

-

We don't know what sex it is, and won't untill it's around 8-12mths old. So we wanted a name that would suit either. Stevie Nicks or Stevie Ray Vaughan for example

-

If you fancy something a bit more than pinking in the garden, but not killing rats. Have a look at Airsoft. You actually get to shoot people there (although Airsoft guns are not quiet as powerful as air guns.

-

So today we picked up our new addition to the family! Meet Stevie everyone! Had some wriggly worms and is now chilling in a temporary home next to me while I study untill the fish tank finishes doing it's cycle.

-

Stiff sole that doesn't bend/collapse when pressure is put on it from the sides. No laces to get caught in leavers/bolts/chain etc. Toe pad - otherwise you'll wear through the leather in the toes with your gear shifter. Thick tounge to provide some shin protection for when you rest the peg against your leg... I wear bike specific alt bergs when on my bike. They are much more comfortable than using Doc Martin or similar I find.

-

Build Lego motorcycles.... Watch or read long way round and long way down. Build your dream bikes on retailers websites and drool over them...

-

You don't even need to threaten anyone with a firearm for the police to come round in a rush... Ask anyone who plays Airsoft and didn't tell their neighbours when they decided to set up their new scope in their back garden… Then try convincing some police that the realistic gun you have is a toy that shoots plastic

-

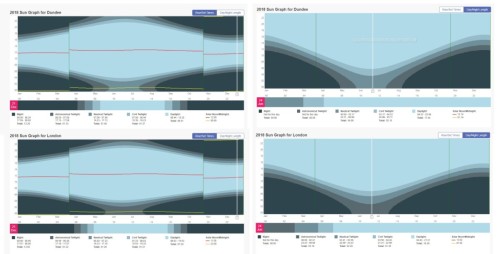

I'm not entirely sure as to the why, but this site give a lovely graphical view of how daylight increases and decreases. Noticable different between north and south of the country https://www.timeanddate.com/sun/uk/

-

Important insurance point

Arwen replied to Pbassred's topic in CBT, Test and Advanced Training Information

Well done on the pass [mention]Pbassred[/mention] . However that is exactly the reason I never insure with MCE. They charge for everything! The £40 is a standard "admin" fee to them. So even if you change house to a safer area that drops your premiums by £30, you still owe them £10. Bikesure on the other hand... Passed my test and installed the akrapovic full exhaust on my grom the same day. Phoned them up to say so, "Oh congrats on the pass! Let me just Update those details.... Does the exhaust system add more then 15hp ?" - "No " - " Cool, it's just classed as cosmetic then, so here is a £30 refund for passing your test, it will be in your bank account in the next 3-5 working days" I was super pleased